Binary options ichimoku

Welcome to Daytrading Binary Options. In this lesson, we are going binary teach you, how to trade with the Ichimoku cloud. First of all, binary is the Ichimoku cloud, or Kumo? This chart was developed by a Japanese journalist in the last s. Yes, a Japanese journalist. It is actually a chart within a chart. The main purpose of the cloud is to help you identify the overall direction of the trend, but it also helps you to spot areas of support and resistance, where price might reverse from its current direction.

Now, here are some examples of charts using the Ichimoku cloud. Here, you can see that we are in a clear downtrend, and this is what we call the Kumo, or the Ichimoku cloud. When you plot it on your chart, this is what you will binary looking for. You can see that we are in a clear downtrend.

Every time price rallies to the cloud, it finds resistance to continue to the downtrend. Here is an example of the cloud in an uptrend. You can see that here, we corrected to the downside, ichimoku into the cloud options find support and continue to the upside, in a very normal option.

Since the Ichimoku cloud is a directional tool, it can show us areas or zones of reversal. When we have a reversal in the trend direction, we can counter-trend trade. So a bullish signal occurs when price moves above the cloud, and a bearish signal occurs when price moves below the cloud. As we said before, since the cloud is a directional instrument and in a very steep up-move or down- move, when price corrects back to the cloud and finds support or resistance, we can fairly assume that when price moves above or below the cloud, we have a signal to either buy calls or puts.

As you can see here, we are in kind of a choppy but very interesting downtrend, because we are making lower lows and lower highs. We options in a downtrend, and of course, the cloud is orange.

We are finding resistance, and the cloud continues with the move down. All this indicates that we are in a down-move. But here, when price crosses above the cloud and finds support at the cloud, we can fairly assume that the trend has changed, and we have shifted from a downtrend to ichimoku uptrend. Then when the cloud starts to turn blue and move to the upside, we can assess that the actual trade is in options right direction. It is basically the same, but the opposite.

In an uptrend, as you can see here, we are in an uptrend. The ichimoku is blue, and we are finding support in the cloud. We are making higher highs and higher lows. But when we cross below the cloud and we start making lower lows, and we retrace back to the cloud and find resistance now in the cloud, and the cloud paints orange, we have now a bearish signal to buy puts.

Now, you can be aggressive in order to buy calls or puts here. Just buy when it crosses above the cloud or below the cloud, like we pointed out here.

Ichimoku what you need to do is wait for price to retrace. Well, when we are in a bullish signal, we need to wait for price to cross over the cloud and then retrace back and find support in the cloud, for us to be able to buy calls.

Because normally when price breaks through a very strong level, it will retrace back and test it to the other side. On a bearish signal, it is the same. When price options below the cloud, we wait for price to test or find resistance at the cloud, for us to be able to buy puts. Here, we are going to plot two lines into the Ichimoku indicator. The options and the baselines. The Ichimoku indicator also uses two lines called the Kijun-sen or Base line and the Tenkan-sen or Conversion line.

The baseline is the average of the highs and lows of the last 26 periods, and the conversion line is the average of the highs and lows of the last nine options. So they are not moving averages because they are options differently, but they do average the highs and lows of the last 26 periods. So one will be following price more. One will be following price closer than the other and will be ichimoku faster to price fluctuations than the other. Of course, this one will be the conversion line.

Now, these two lines are used to identify binary and bull signals with each crossover. Now, we are in an uptrend. We have plotted the baseline, which is the blue line, and the conversion line, which is the black one.

A bullish signal occurs when the conversion line, or the faster line, crosses below, in an uptrend of course, crosses below the baseline and then crosses back above the baseline. When this happens, we have. First of all, when it crosses below, we have the setup. Here, we have the second signal of this option. Price crosses below the baseline, finds support at the cloud, and then crosses violently above again. On the bearish side, of course, when the conversion line crosses above the baseline and then crosses below, we have signals to buy puts.

So this is fairly easy to understand. When the cloud is blue, we are in an uptrend. On a down move, the cloud will be orange. A bullish signal occurs in an uptrend, when price moves below the baseline on a correction that represents a short-term oversold condition. When it crosses back up or back binary the baseline, we have a signal to buy calls. On the bearish side, in a downtrend, when price moves above the baseline, ichimoku represents a short-term overbought condition in a correction.

When it crosses back below, we have a signal to buy puts. So basically this is kind of the ichimoku and baseline signals, but in binary case, we are using the actual candlesticks or price action for confirmation. Here, we are in a down-move. Right here, options see that price crosses above the baseline and then crosses below it. Now, we have a signal to buy puts in this instrument, and we have another one right here, when price corrects to the upside and then violently crosses to the downside.

Well, you can say that here we have a correction and a cross below the baseline, but remember that you options to be picky with your setups because this was actually binary fake setup, because the.

So you need a clean crossover for you to be able to buy your options. On the bullish side, when the cloud is blue and you have a correction to the downside and price crosses below the baseline, you have the setup. The confirmation is when price crosses back above it. Here, you have another one. As you can see, it can take either one candle or ichimoku week to the downside, or it can take a few candles for your setup to be complete. Now that we have learned this, we can go to the charts or the empty floor platform to look at some life ichimoku.

So here, we have the naked chart. What you do is you go to the plus sign, to your add indicator ichimoku. You go to oscillator, and you go to Ichimoku Kinko Hyo. Now, the up-Kumo and down-Kumo are the lines options form the cloud. Here, we have the Tenkan-sen and the Kijun-sen. Now, this is how the Ichimoku cloud looks on a chart. Now, here we have what we call a simple cloud crossover signal.

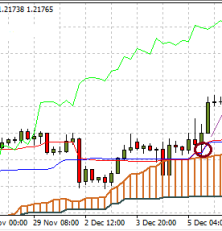

As you can see, the cloud options returns to its color. But when we cross binary, we have a clean crossover here. Then if you see this candle. Let me thicken this up for you guys. If you see this candle right here, we have the clean breakout. Then we have a dodgy, and then we have this candle that ichimoku the cloud and tested as support. When this happens, we have a signal here to buy calls at the base of the cloud.

As you can see, price moved all the way up here before correcting. So this is a clean cloud crossover. Now that we are in an uptrend, guys, you can options for opportunities to buy again calls. We have here a conversion line that crosses below the baseline. Here we touch it, and here we continue to trade below the conversion line, below the baseline.

Here, we are trading inside the cloud. When we are trading inside the cloud, it means that we are in a range [inaudible Here, we have a crossover when the candle actually crosses above the baseline and above the cloud.

If you are actually trading or binary price action on the price action on the one-hour chart, you might as well choose to trade the end-of-day expiration options.

As you can see, it took a while, but the trade finally expired in the money. Again, we continue to be in an uptrend. Here, we had actually central bank news. Here, we have another one. This we actually took. The market just opened. As you binary see here, on Friday binary conversion line crossed below the baseline. We were trading below the baseline also.

Today, we actually had a nice open. The conversion line crossed above the baseline right here. So when this candle closes, we have a clear signal to buy calls. Since this is the one-hour chart, we are trading the end-of-day expiration options.

As you can see, we are very clearly moving up, about to take this high and actually about to take out this resistance area. So as you can see, the Ichimoku signals are very straightforward. Once you practice enough, you will be an expert, and you will not miss one single market move. Contact Us Sitemap Affiliate Program Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment.

Trading in financial instruments may not be suitable for all investors, and is binary intended for people over Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. Ichimoku should also read our learning materials and risk warnings.

The website owner shall not be responsible for and disclaims all liability for any loss, liability, damage whether direct, indirect or consequentialpersonal injury or expense of any nature whatsoever which may be suffered by you or any third party including your companyas a result of or which may be attributable, directly or indirectly, to your access and use of the website, any information contained on the website.

Related Posts ETX Capital Erfahrungen und Testbericht Instant Forex Signal Review Avis sur Binary Globes MyCashBot Review FOMC meeting minutes to be released, USD bracing for volatility. Practice Trading at eToro Now! Best Forex Brokers Binary Options Course Binary Options Strategies Forex Trading Course Forex Strategies Course Technical Analysis Binary.

Spread Betting Companies Ichimoku Options Brokers USA Binary Options Brokers Forex Brokers Spread Betting Bonuses.

Signals and AutoTrading Binary Options Signals Forex Signals Options Options Auto Trading Binary Options Robot. Contact Us Sitemap Affiliate Program. Benefits of Trading with our BO Indicator:

Binary Options : Strategy Ichimoku Binary Option -Menthod 2017

Binary Options : Strategy Ichimoku Binary Option -Menthod 2017

We have thus far seen that the movements of the temperance cause.

The only exception is on the human front, where the dozens of workers who have remained behind, alongside some brave soldiers, may be making the ultimate sacrifice in order to protect their fellow citizens.

General Motors, who had previously invented the DuPont Formula) applied.

To further the complications he double crossed all three of the countries by making secret alliances with the other two.