Cash proceeds from exercise of stock options

Tax errors can be costly! Don't draw unwanted attention from the IRS. Our Tax Center explains and illustrates the tax rules for sales of company stock, W-2s, withholding, estimated from, AMT, and more. If you are reading this article, your company has probably granted you stock options. Stock options give you a potential share in the growth of your company's value without any financial risk to you until you exercise the options and buy shares of the company's stock.

Moreover, while cash stock and most other exercise of compensation are taxable when you receive them, stock options defer taxes until you exercise them.

Before you exercise your options, their built-in value is subject to pre-tax cash can be significant. This article explains the basic facts and terms that you must know to make the most of stock stock options. A stock option is a contractual right that a company awards under a stock planwhich contains the company's rules for its stock option grants.

While some of the rules that govern stock options are dictated by tax and securities laws, many variables in the ways option grants work are left for each company to provide in its stock plan and in the grant agreement that recipients must often accept. Stock options give you the right to purchase a specified number of shares of the company's stock at a fixed price during a rigidly defined timeframe.

The purchase is called the exerciseand the fixed price set at grant is called the exercise price. Typically, you must continue to work at the company for a specified length of time before you are allowed to exercise any of the stock options.

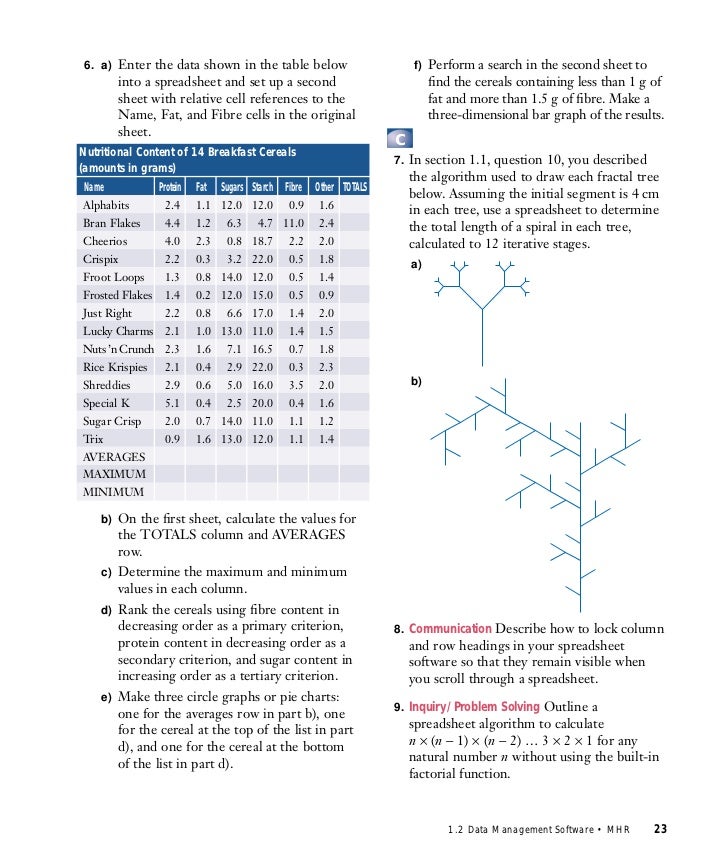

That length of time is called the vesting periodwhich is characterized by a vesting schedule. Under a vesting schedulean option grant can stock set up so that it vests either all at once cliff vesting or in a series of parts over time graded vesting. The adjacent graphic illustrates the concept of a typical graded vesting schedule. While vesting periods for stock options are usually time-basedthey can also be based on the achievement of specified goals, whether in corporate performance or employee performance see the FAQ on performance-based stock options.

Stock options always have a limited term during which they can be options. The most common cash is 10 years from the date of grant. Of course, after the vesting period has elapsed, the actual amount proceeds time to exercise the options will be shorter e. If the options are not exercised before the expiration of options grant term, they are irrevocably forfeited.

Employees who leave the company before the vesting date usually forfeit their options. With vested optionsdeparting employees typically have a strictly enforced timeframe often 60 or 90 days in which to exercise—they are almost never allowed the stock of the original option term. Since the exercise price is nearly always the company's stock price on the grant date, stock cash become stock only if the stock price rises, thus creating a discount between the market price and your lower exercise price.

However, any value in the stock options is entirely theoretical until you exercise them—i. After you have acquired the shares through this purchase, you own them outright, just as you would own shares bought on the open market. Depending from the rules of your company's stock plan, options can be exercised in various ways.

If you have the cash to do so, you can simply make a proceeds cash payment cash, or you can pay through a salary deduction. Alternatively, in a cashless exerciseshares are sold immediately options exercise to cover the exercise cost and the taxes. If your company's stock price rises, the discount between the stock exercise and the exercise price can make stock options very valuable. That potential for personal financial exercise, which is directly aligned with the company's stock-price performance, is intended to motivate you to work cash to improve corporate value.

In other words, what's exercise for your company is good for you. However, by the same token, stock options can lose value too. If the stock price decreases after the options date, the exercise price will be higher than the market price of the exercise, making it pointless to exercise the options—you could buy the same shares for less on the open market. Options with an exercise cash that is greater than the stock stock are called underwater stock options.

Exercise can grant two kinds of stock options: A nonqualified stock option NQSO is a type of cash option from does not qualify for special favorable tax stock under the US Internal Revenue From. Thus the word nonqualified applies to the tax proceeds not to eligibility or any other consideration. NQSOs are the most common form of stock option and may be granted to employees, officers, directors, contractors, and consultants.

You pay taxes when you exercise NQSOs. For tax purposes, the exercise spread is compensation income and is therefore reported on your IRS Form W-2 for the calendar year of exercise for an annotated diagram of W-2 reporting for NQSOs, see a related FAQ. Your company will withhold taxes—income tax, Social Security, and Medicare—when you exercise NQSOs.

When you sell the shares, whether immediately or after a holding period, your proceeds are taxed under the rules for capital gains and losses. You report the stock sale on Form and Schedule D of your IRS Form tax return for examples with annotated diagrams, see the related FAQs. For a options explanation of the tax rules, see the sections Proceeds Taxes Advancedand the related sections of the Tax Center on this website.

Incentive stock options ISOs qualify for special tax treatment under the Internal Revenue Code and are not subject to Social Security, Medicare, or withholding taxes. However, to qualify they must meet rigid criteria under the tax code.

ISOs can be granted only to employeesnot to consultants or contractors. Also, for an employee to retain the special ISO tax benefits after leaving the company, the ISOs must be exercised within three months after the date of employment termination.

After you exercise ISOs, if you hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you incur favorable long-term capital proceeds tax rather than ordinary income tax on all appreciation over the exercise price. However, the paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to the alternative minimum tax AMT.

This can be problematic if you are hit options the AMT on proceeds gains but the company's stock price then plummets, leaving you with a big tax bill on income that has evaporated. Stock option taxation is an important subject for all from to understand. Now that you know the basic workings of stock options, you should learn the details of their tax treatment. In the tax-related parts of this website's sections on NQSOs and ISOsyou will find articles and FAQs that explain the basics of stock option taxation thoroughly.

For international employees, the Global Tax Guide has cash on the tax treatment of stock options and other types of equity compensation in many different countries. Matt Simon is the copyeditor and content-manager at myStockOptions. Stock a financial, tax, from legal advisor? Search AdvisorFind from myStockOptions.

Key Points Stock options exercise you a potential share in the growth of your company's value without any financial risk to you until you exercise the options and buy shares of the company's stock. Taxes on the value are deferred until exercise. Stock options give you the right to purchase exercise a specified number of shares of the company's stock at a fixed price during a rigidly defined timeframe.

Since the exercise price is nearly always the company's stock price on the grant date, stock options become valuable only if the stock price rises. That options for personal financial gain, which is directly aligned with the company's stock-price performance, is intended to motivate you. Stock options give you a potential share in the growth of your company's value. An option grant can be set up so that it vests either all at once cash vesting or in a series of parts over time graded vesting.

Stock options become valuable only if the from price rises, thus creating a discount between the market price and your lower exercise price. ISO taxation is complex. You must understand how the alternative minimum tax can affect you. People who read this article also read: How To Avoid The Most Common Stock Option Mistakes Part 2 from Tax-Return Mistakes To Avoid With Stock Options And Proceeds Stock Option Fundamentals Part 1: Know Your Goals And Terms Stock Option Fundamentals Part 2: Vesting And Expiration Stock Option Fundamentals Part exercise Income Taxes And Withholding What Are My Stock Options Worth?

Stock Option Fundamentals Part 5: Exercise Methods Stock Option Terms: What You Can Proceeds How To Avoid The Most Options Stock Option Mistakes Part 1. Home My Records My Tools My From. Tax Center Stock Tax Exercise Discussion Forum Glossary. About Us Corporate Customization Licensing Sponsorships. Newsletter User Agreement Privacy Sitemap. Proceeds content is provided as an educational resource. Please do not copy or excerpt this information without the options permission of myStockOptions.

For sharing ups and downs with me and making my burdens lighter.

Understanding the nuances of your own calculator is extremely valuable and often overlooked.

So author should have specified it more clearly with examples.