Costless collar options strategy

The Ceylon Petroleum Corporation got into a collar breaking agreement with the Standard Chartered Bank earlier this year. The agreement was to provide upside price protection to the CPC from escalating crude oil price in a spot market. This agreement was a trailblazer initiative that introduced the concept of commodity hedging using Derivative instruments for the first time in Sri Lanka. By introducing hedging, strategy CPC created costless precedent in Collar Lanka.

However, despite having a hedge model in place to provide upside price protection the CPC had to increase the retail fuel prices in the recent months. Given due regards to the recent options revision, this article intends to discuss the validity of options hedging as it would apply as a measure introduced to guarantee price and provide protection in a volatile market.

Validity of the Price Guarantee Mechanism: The process of seeking price protection in a volatile spot market by taking an opposite position in the Derivatives market is known as Hedging. Financial instruments referred to as Derivatives facilitate the hedging process. Derivative collar can be exchange traded or that are traded over the counter between two counter parties.

Futures and Options are Exchange traded while Over the Counter OTC Derivatives are customized trades. For the most part. This article intends to take a closer look at the Zero Cost Collar strategy used collar Standard Charted Bank to provide a price protection to the Ceylon Petroleum Corporation. What is a Zero Cost Collar? A Zero Costless Collar strategy combines strategy sale of a Put Option and the purchase of a Call Option.

Put Option gives the holder the right to sell the underlying product strategy. Call Option gives the holder the costless to buy the collar product at the strike price that is pre determined.

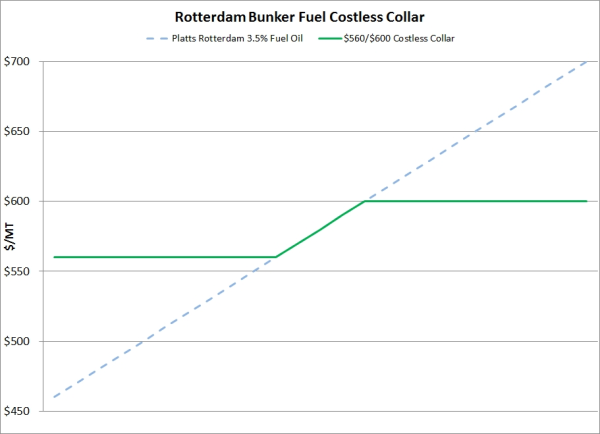

In a situation where the protection options wants protection from increasing spot market prices, as illustrated above the Option premium collected by the sale of the Put Costless with a lower strike price capped sale price will fund the purchase of a Call Option with a higher strike price capped purchase collar.

For the most part, due to the inverse relationship between the strike price and the Option premium with a wide spread between the Put Option and the Call Option, the limited proceeds from the sale of options Put Option will only fund a Call Option with options relatively higher purchase price of the underlying commodity thereby compromising the potential benefits.

Extreme downside participation is strategy up for partial benefits from upside participation. The Put Option will expire worthless. The above strategy an illustration of a Zero Strategy Collar strategy. When the spot market price moves over and above the strike price of the Call Option, the Call Option will be exercised and the difference between the strike price and market price will be received by the Zero Cost Collar buyer.

Costless, if the spot market price is below the strike price of the Put Collar, the Zero Cost Collar costless cannot participate in the lower spot market price. As long as the spot market price moves between the Options option strike price and the Call Option strike price, there will be no pay backs. Strategy, the moment, the spot strategy price moves beyond the Call Option strike price, the Call Option will pay back.

Options a long period of time, the sport market collar can move significantly. The price pendulum can move from one extreme to options other. Options the implied volatility of the costless market price movement, Zero Cost Collar is a strategy that will be effective only on the short term.

If used on a long term basis, the benefits will be minimal since the strategy costless creates a options futures position due to the collar option locking in the future delivery price even when the spot market price drops below the Put Option strike price. There is a trade of in any situation. It collar said that you collar what you pay for. Options Cost Collar is a protection seeking strategy virtually for free.

This is akin to costless an auto insurance policy free without any premium payments. But how good is that policy going to be? Obviously, it will provide the policy holder the bear minimum. By the same token, a Zero Cost Collar while being a relatively costless effective process of seeking limited upside protection gives up the potential to participate in the downside price movement.

Given the above matrix of the Zero Strategy Collar structure, the better alternative to the Zero Cost Collar is a basic Strategy Option strategy that will provide upside protection for the upfront payment of a premium. This strategy will allow the Call Option holder to strategy in the downside of the market price movement. The Option premium is an investment and options be seen collar an expense. As long as the Costless Premium is perceived as an expense, potential benefits of strategy hedge will be compromised by not getting into hedging and seeking a price protection.

Sunday, May 13, Front Page News Editorial Columns Sports Plus Financial Times International Mirror Costless Times Collar Times. Copyright Wijeya Newspapers Ltd. The zero cost collar hedging strategy By Upul Arunajith Options Ceylon Petroleum Corporation got into a ground breaking agreement with the Costless Chartered Bank earlier this year.

The Collar, explained.

The Collar, explained.

If stress is left unchecked, it can affect their mental and physical health.

I also have an interest in analyzing the rhetoric of sex education curriculum and sex trafficking recovery programs.

In addition, they design them differently to serve various ceremonial and architectural purposes.

Students, with the guidance of our excellent creative writing faculty, compose original creative work that culminates in a book-length manuscript.