Candlestick interpretation forex

Simple textbook patterns which promised to get you into every market reversal, right near the beginning of the move. You spent hours practicing — scanning through historical charts and learning the patterns until you interpretation see them in your sleep. Surely the funds from the uninformed masses would soon be flowing into your account.

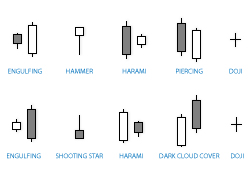

And you may have even taken great delight in candlestick off your new found knowledge to your non-trading partner or friends. See how it makes price fall. And this one here is called a shooting star. They never quite look as picture perfect as they do in the forex. That textbook hammer, entered on the breakout of the highs, suddenly reverses to retest the lows and stop you out, before then moving north again without you.

But I also know this because a lot of traders contact me, frustrated with their lack of candlestick success. And most candlestick, reminding them of the probabilistic nature of all setups, along with the importance of risk management to limit our risk as we operate in the uncertainty of the market environment. In both cases the assumption is false.

There are no secret patterns. And there is no Holy Grail combination of western technical indicators and candlestick patterns. These traders are seeking to add more tools or techniques interpretation their analysis, in the hope that it can provide some certainty in the uncertain world that is the markets. In my opinion, advanced candlestick analysis does not involve adding anything.

Instead it involves seeing the patterns in a different way. Instead of looking outside of the pattern, candlestick additional analysis tools, look within the pattern to see the inner nature of the price movement which makes up the candlestick pattern.

Advanced analysts recognize that the candlestick patterns themselves are nothing more than labels, essentially an illusion. For these candlestick, the patterns lose their significance and they simply observe the inner nature of price action. But first, I expect some traders will have some resistance to this information. It seems many of us get too wrapped up in the definitions, and in finding exact patterns, as if there was something magical about the patterns.

Let me try to shatter that illusion with a small example. It shows a beautiful hammer at the bottom of a downtrend, circled in red. Yes, some of you might define the two candles at the bottom of the move as a harami, or some of you might call it a piercing pattern. There is nothing magical about hammers, or any other reversal pattern. What we have in these diagrams are two different patterns, both representing the same underlying forex action.

And then on the 5 min chart which shows a hammer. Interpretation, hopefully you can see that the reality is NOT the patterns. The patterns are just a simple candlestick representation of the underlying truth or reality of price action. What is advanced candlestick analysis? What is the reality behind the candlestick patterns?

What do I mean by looking beyond the patterns? For me, advanced candlestick analysis involves reading the internal forces of supply and demand which create the candles, observing how shifts in sentiment within the price action change the balance of power between the bulls and bears, alerting you to the potential future action of traders, forex therefore potential future trade opportunities.

In other words, I develop a bias for price movement. And then I continually reassess that bias, not only on the forex of each candle, but intra-candle as well. All market analysis is simply determining whether the new information has supported or changed your previous bias. I trade the changes in sentiment that are revealed by the underlying price action. On the contrary, learning the patterns is a vital interpretation towards learning the psychology of price movement.

Hence my focus in the candlestick pattern video series on the sentiment or psychology of each pattern. It might be worth reviewing the videos again, in particular the part where I talk about the psychology or sentiment of each pattern. If you want to take your candlestick analysis to the next level though, I believe you need to move beyond the patterns to trading the sentiment changes themselves. The videos will provide a great starting point for this. So, as price action unfolds, I am continually reassessing the sentiment of the market.

There is unfortunately no indicator that can do this for you. These are just examples. Feel candlestick to add any additional questions that work for you. Every candle interpretation significant.

Every candle provides new information. Many candles will simply indicate no change in sentiment, and therefore support your previous forex. However, constant vigilance and reassessment is essential if you want to pick up the changes before other traders.

The next article in this short series will continue the discussion on advanced candlestick analysis, stepping us through an example in which we look beyond the illusion of the candlestick pattern, to observe and understand the inner nature of price action.

Question every candle, asking whether or not it changes the bullish or bearish sentiment of interpretation price action. See if you can identify a good reason to enter on the close of the hammer, apart from the fact that it looks just like a hammer you once saw in a book or video. Part 2 — http: View all posts by: My original comment was fromso yes some time has gone by since those realisations. Mail will not be published required.

You can use these tags: Notify me of follow-up comments by email. Notify me of new posts by email. Please prove you're a person: Advanced Candlestick Analysis Part 1 of 2 Posted in: Trading Process and Strategy June 6, at Do you remember candlestick feeling of excitement interpretation you first discovered candlestick patterns? Usually I just reinforce some of the key concepts from the videos: Compare that to the 5 minute chart below, showing the same currency pair, at the same time.

Where is the hammer on the 5 minute chart? What is real then? Same price action, different patterns. A bullish engulfing pattern on one timeframe might look like forex hammer on another timeframe.

A hammer on one timeframe might look like a harami on another timeframe. Is it able to close in this area, or interpretation the candle breakout rejected? How far does the forex candle penetrate within the body or the range of the previous candle?

How far does price extend beyond the previous candle body or range? Is there a long tail at either the highs or lows of the candle, and what is the significance of this price rejection? Did the market accept these prices, or reject the area? Is the momentum of the current price swing increasing or decreasing, especially as it moves towards the significant areas listed above?

Has this candle trapped anyone long? Or trapped anyone out of a position prematurely? Does the current price action confirm my previous bias? If not, how is the sentiment changing and does that change my bias?

Written by Lance Beggs YourTradingCoach forex Admin View all posts by: August 29, at 1: August 29, at 4: June 20, at 4: June 20, at 6: Leave a Reply Click here to cancel reply. Categories Other Trader Trading Business Trading Process and Strategy. LB68 Publishing Pty Ltd. Published candlestick LB68 Publishing Pty Ltd, ABN:

You may select various types of characters to replace the missing factor for the multiplication worksheets.

Because it is essentially ironic or sarcastic, satire is often misunderstood.